Privatization of Banks

-

Context

Topic – GS-III (Economy)

SUB – TOPIC - Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Government Budgeting

Recently NITI Aayog released its last round of consolidation plans. In that, the NITI Aayog listed 6 banks for the privatization plan.

-

Background

- The Union Budget 2021 has announced the privatisation of two public sector banks and one general insurance company in the upcoming fiscal 2021-22.

- The Government has fast-paced the privatization of PSBs (Public Sector Banks).

- The government front-loaded Rs 70,000 crore into government-run banks in September 2019, Rs 80,000 crore in in FY18, and Rs 1.06 lakh crore in FY19 through recapitalisation bonds. In 2019, the government merged ten PSU banks into four.

- Now, the NITI Aayog listed 6 banks for the privatization plan.

- The government aims to keep a bare minimum presence in the strategic sector. The final number of Public Sector entities in strategic sectors (including banking) will be determined by a group of ministers.

-

Analysis

What are the reasons for privatisation of banks?

- Degrading Financial Position of Public Sector Banks:

- Years of capital injections and governance reforms have not been able to improve the financial position of public sector banks significantly.

- Many of them have higher levels of stressed assets than private banks, and also lag the latter on profitability, market capitalisation and dividend payment record.

- Issue of Dual Control: At present PSBs are under the dual control of RBI and Dept. of Financial Services of Min of Finance.

- The RBI handles the governance side of the PSBs under the RBI Act, 1934

- On the other hand, the Dept of Financial Services under the Finance Ministry maintains the regulation of PSBs under the Banking Regulation Act, 1949.

- Thus, RBI does not have the powers to revoke a banking license, shut down a bank, or penalize the board of directors for their faults. The Privatization will provide the powers to RBI to control them effectively.

- Part of a Long-Term Project

- Privatisation of two public sector banks will set the ball rolling for a long-term project that envisages only a handful of state-owned banks, with the rest either consolidated with strong banks or privatised.

- The initial plan of the government was to privatise four. Depending on the success with the first two, the government is likely to go for divestment in another two or three banks in the next financial year.

- This will free up the government, the majority owner, from continuing to provide equity support to the banks year after year.

- Through a series of moves over the last few years, the government is now left with 12 state-owned banks, from 28 earlier.

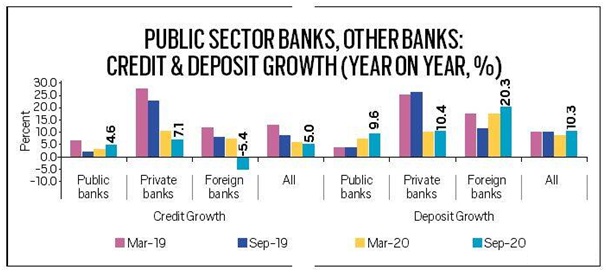

- Reduced performance: The PSBs in the past failed to perform effectively when compared to Private Banks. This will result in a loss for the government at the end of the day.

- For example, The PSBs had almost 71% of the overall lending ratio in 2005. But in 2020 their overall lending ratio came below 57% due to intense competition from the Private Banks.

- Public sector bank boards are still not adequately professionalized. Further, the Bank Board Bureau is not fully functional. So the government still decides board appointments. This creates an issue of politicization and interference in the normal functioning of Banks.

- Impact of Covid:

- After the Covid-related regulatory relaxations are lifted, banks are expected to report higher NPAs and loan losses.

- As per the RBI’s recent Financial Stability Report, gross NPA ratio of all commercial banks may increase from 7.5% in September 2020 to 13.5% by September 2021.

- This would mean the government would again need to inject equity into weak public sector banks.

-

What were the Contribution of PSBs so far?

According to RBI data, there were only 1,833 bank branches in rural areas in the country in 1969. But after the nationalization in the 1970s, the rural branches increased to 33,004 by 1995 and continued to grow over the next decades. This provided various benefits to economic development. Such as,

- Agricultural growth: PSBs expanded agricultural credit, short-term agricultural credit (‘crop loans’). According to an estimate, the PSBs in 2017-18 account for a total of Rs 622,685 crores of Agricultural credit.

- Further, The PSBs also played a huge role in making the country self-sufficient by supporting the green, blue, and dairy revolutions.

- Priority sectors: The PSBs pioneered the concept of ‘priority sector lending. This provided credit to certain priority sectors which were earlier deprived of credit such as housing, etc.

- Solution for poorest: The Differential Rate of Interest (DRI) loans are the brainchild of public sector banking. Under this poorest section of people will receive the loan at a very marginal interest rate.

- Women empowerment: The PSBs extended loans to women’s self-help groups under various programs. This contributed to women’s empowerment in India.

- Rural growth: PSBs also funded rural infrastructure projects through the Rural Infrastructure Development Fund.

In conclusion, the PSBs provided access to a formal banking network for all and facilitated financial inclusion in India.

- Agricultural growth: PSBs expanded agricultural credit, short-term agricultural credit (‘crop loans’). According to an estimate, the PSBs in 2017-18 account for a total of Rs 622,685 crores of Agricultural credit.

-

Views against the Privatization of PSBs

The supporters of PSBs provide many arguments against the privatization of PSBs. Such as,

- Credibility of Private Sector Banks: The Private sector bank is not always efficient. On a global level, there are many private banks that have failed, thus challenging the idea of private banks are efficient. For example, the recent YES Bank problem in India.

- Reason for NPA’s: The present NPA problem lies majorly with the PSBs. But the NPA’s increased due to the credit provided to the private corporate entities. So the private corporate entities have to be regulated and not the PSBs.

- Against inclusive banking: The Private Sector focussed on profit motive might restrict the credit to rural, agricultural, women, poor sections of society, etc. Thus, after Privatised PSBs the remaining PSBs have to take care of all of such credits. This might stress the remaining PSBs also.

- Governance and policy issue of RBI: Restructuring schemes such as strategic debt restructuring and schemes for sustainable structuring of stressed assets, initiated by RBI, are the major reasons for delayed recognition of bad loans from banks. This is applicable to all banks irrespective of ownership (public as well as private) of the banks.

For these reasons only the Former governor of RBI, Raghuram Rajan also opposed the Privatization of PSBs. He also mentioned that India at present needs changes in banking regulation.

-

What are the challenges associated with increasing Privatisation of Banks?

- Private Banks are not without faults

- In the last couple of years, some questions have arisen over the performance of private banks, especially on governance issues.

- ICICI Bank MD and CEO ChandaKochhar was sacked for allegedly extending dubious loans.

- Yes Bank CEO Rana Kapoor was not given extension by the RBI and now faces investigations by various agencies.

- Lakshmi Vilas Bank faced operational issues and was recently merged with DBS Bank of Singapore.

- Former Axis Bank MD Shikha Sharma too was denied an extension.

- Moreover, when the RBI ordered an asset quality review of banks in 2015, many private sector banks, including Yes Bank, were found under-reporting NPAs.

- Dangers of private banks repeating the mistakes of 1960s

- There is widespread perception that the private sector then was not sufficiently aware of its larger social responsibilities and was more concerned with profit.

- This made private banks unwilling to diversify their loan portfolios as this would raise transaction costs and reduce profits.

- The expansion of branches was mostly in urban areas, and rural and semi-urban areas continued to go unserved.

- Private Banks are not without faults

-

Suggestive Measures

In order to improve the governance and management of PSBs, there is a need to implement the recommendations of the PJ Nayak committee. The government must properly implement the recommendations of various committees. Such as,

1. Recommendation of PJ Nayak Committee:

-

- Though the government approved the Bank Board Bureau, the government has to provide enough support for proper functioning.

- The government can split the Chairman and Managing Director roles. Further, the state can allow them a fixed tenure of 3 to 5 years.

2. Recommendations of Narashimham committee

-

- The government can review the Banking Regulation Acts.

- India can explore the concept of Narrow Banking. Under this weak PSBs will be allowed to place their funds only in the short term and risk-free assets. This will improve the performance of PSBs.

- Apart from that, the government has to create strong recovery laws and taking criminal action against wilful defaulters.

- The government has to rectify the challenges in the Insolvency and Bankruptcy Code. This will provide a faster resolution process.

- In the meantime, the government can explore alternate steps such as the concept of Bad Banks.

-

-

Conclusion

The majority of the Committees appointed by the government including the PJ Nayak Committee supported the reduction of government stake in PSBs. So, the government has to strike a balance on how much privatization of PSBs is essential for financial inclusion and credit to essential sectors like infrastructure, rural, etc. Instead of providing arbitrary numbers, the government have to provide the rationale behind the bare minimum presence in the strategic sectors including PSBs